From Ideas to Processes in Seconds

Transform your insurance processes with smarter, faster automation.

Try our all-in-one platform for free below.

Transform your insurance processes with smarter, faster automation.

Try our all-in-one platform for free below.

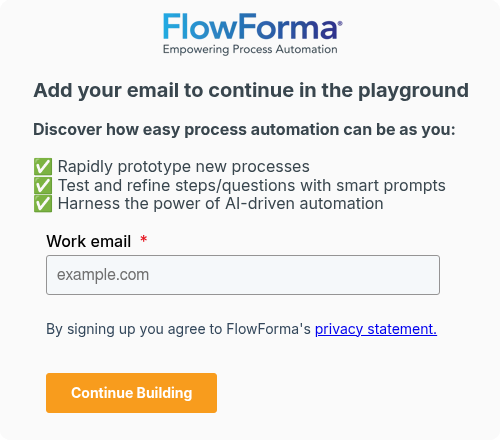

Use this playground to prototype your process in seconds. When you're ready to add sophisticated logic, test scenarios, and move to production, unlock the full experience with a 7-day free trial.

✔ Build workflows in minutes using Copilot & advanced agentic AI

✔ All-in-one access (Copilot, forms, workflows & document generation)

✔ See your process go from a prototype to live process

✔ Get process optimization advice and 1-2-1 access to process experts

Have Question? We are here to help

FlowForma unites forms, workflow, insights, AI, document generation, and much more into one powerful platform for business process automation.

It's a no‑code, AI‑powered DPA platform built for speed, ease, and deep Microsoft ecosystem integration. It allows rapid automation of business processes with governance, insights, and document handling all in one place.

FlowForma supports the insurance industry by transforming traditionally manual, paper-based processes into streamlined, digital workflows—without the need for coding. This no-code platform empowers business users to quickly build and modify workflows, making it easier to adapt to regulatory changes and evolving market demands.

In addition to process efficiency, FlowForma plays a crucial role in enhancing compliance and governance. Insurance is a highly regulated industry, and FlowForma ensures that workflows are auditable and fully traceable, helping firms meet standards such as DORA and GDPR, and other regional regulations.

FlowForma’s AI Suite enhances its no‑code process automation platform with four powerful generative AI capabilities.

Copilot acts as an intelligent process builder.

The AI Agent Rule lets users embed domain‑specific AI agents within workflows to read uploaded documents—like invoices—automatically extracting, validating, and formatting data per user‑defined instructions.

The Smart Assistants feature guides both builders and end‑users by offering auto‑suggested configuration steps, natural‑language triggers for workflows, and in‑process to‑do prompts. AI

Summarization generates real‑time, context‑aware summaries of form entries and workflow history.

Using agentic AI, FlowForma Copilot can convert simple natural-language prompts—describing the process, steps, or even an uploaded process diagram —into a working prototype in seconds, reducing build time from hours to minutes.

Once you have built your process prototype, register for a free trial, and you’ll be able to add sophisticated logic, test scenarios, and move your automated process to a live production environment.

FlowForma is designed for IT and business leaders in the insurance industry. Its features, including compliance and governance, make it well-suited for highly regulated, process-driven industries such as insurance.

Yes, it does. FlowForma Process Automation sits on SharePoint Online - which is part of the Microsoft 365 suite - and can integrate with other Microsoft 365 applications.

FlowForma Process Automation empowers organizations to easily connect to thousands of systems and applications.

FlowForma helps organizations manage and maintain compliance by automating processes, enforcing consistent practices, and providing clear audit trails—all without requiring code.

FlowForma enables insurance companies to automate and digitize core processes such as claims handling, policy administration, underwriting approvals, and customer onboarding—without the need for coding or IT support. By eliminating manual paperwork and streamlining workflows, insurers can significantly reduce processing times, minimize errors, and improve compliance with industry regulations.

With its no-code platform and seamless integration with Microsoft 365, FlowForma allows business users to build, customize, and manage workflows independently. This enhances operational agility, ensures consistent data capture, and provides greater visibility across departments. The result is faster service delivery, improved customer satisfaction, and a more efficient, cost-effective insurance operation.